Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Mike Hanson

Office Hours

Address

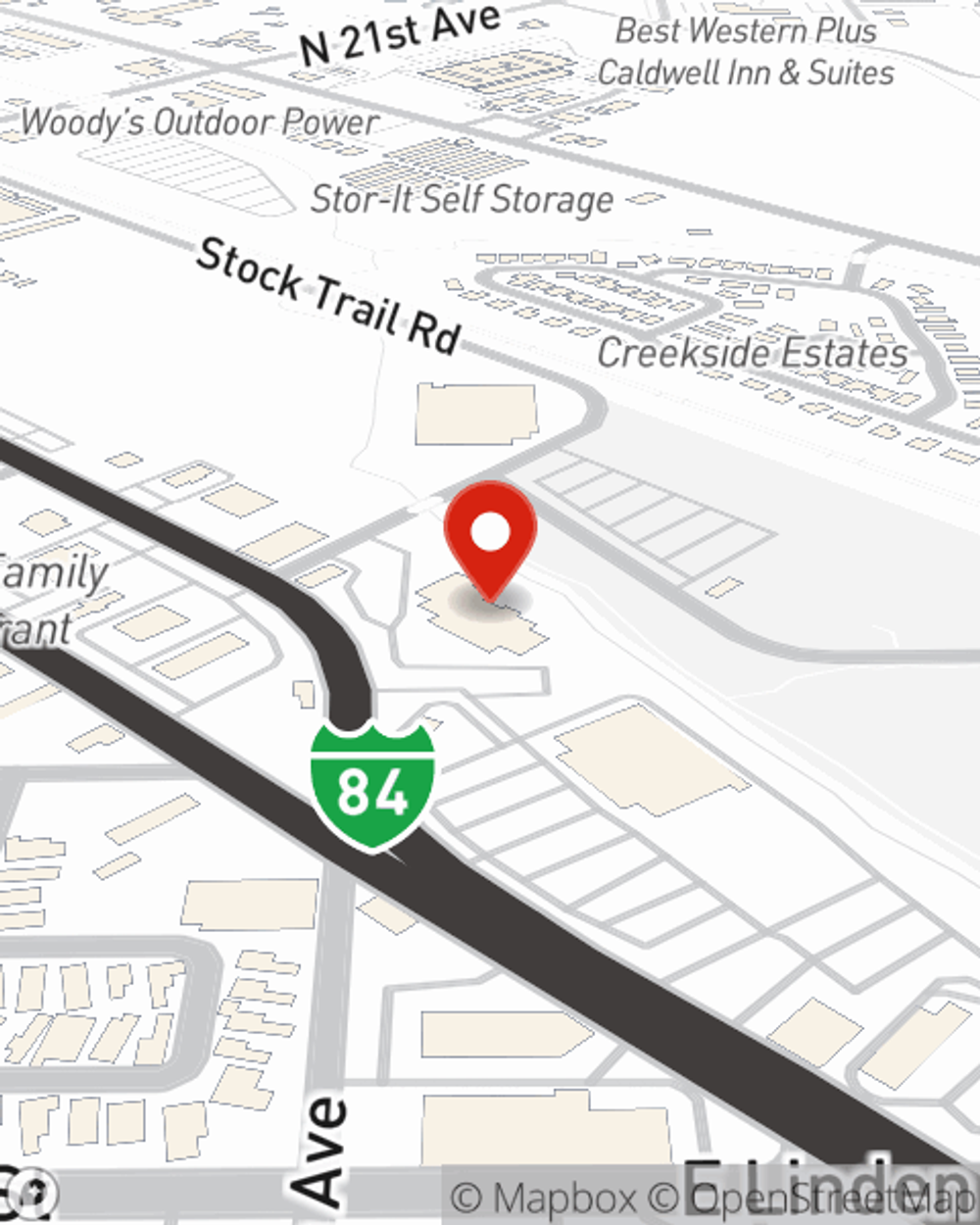

Caldwell, ID 83605-4686

In the Willows Complex - right next to Stewarts Bar and Grill.

Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

-

Phone

(208) 454-5564 -

Fax

(208) 454-2107

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Office Info

Office Hours

-

Phone

(208) 454-5564 -

Fax

(208) 454-2107

Languages

Simple Insights®

Buying modern manufactured homes

Buying modern manufactured homes

Buying a manufactured or modular home can be a confusing process, but using this guide from State Farm® can help decipher some of the mystery.

Getting off to the right start: Auto insurance for foreign drivers

Getting off to the right start: Auto insurance for foreign drivers

If you are visiting the U.S. or are an immigrant that recently arrived in the country, car insurance is essential if you plan to drive.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Social Media

Viewing team member 1 of 6

Trina Hanson

Customer Service Manager

License #19547573

Trina is a warm-hearted member of our team who was born and raised in Idaho Falls, Idaho. In 2006, she made the move to the Treasure Valley, where she fell in love with the beauty of nature and spending quality time with her husband, children, and 16 grandchildren. Trina takes great joy in welcoming new members to our Caldwell community and providing them with the support they need to face unexpected challenges. With her extensive licensing in Property, Casualty, Life, and Health coverage, Trina is well-equipped to answer any questions you may have. With over two decades of experience in customer service and operations, she excels in helping customers with claims and billing matters. Our customers hold her in high regard and appreciate her dedication and caring nature. Trina truly embodies the heart and soul of our agency.

Viewing team member 2 of 6

Brittney Escott

Account Manager

License #20002388

Let me introduce you to Brittney, a friendly and knowledgeable member of our team! Born in Idaho Falls and now residing in Meridian with her boyfriend and their lovable dog, Atlas, Brittney has been a cherished part of our agency for several years. With her extensive licensing and experience in auto, home, and life insurance, she is excited to continue serving the Caldwell community. Brittney's passion lies in helping our customers and ensuring their lives go right. She has a knack for explaining coverage in a way that is easy to understand and loves educating our customers about the importance of their policies. Working with Brittney is a delight, as she has built strong connections with our customers who appreciate her expertise and friendly approach.

Viewing team member 3 of 6

Leigh Gravseth

Account Manager

License #11199855

Let me introduce you to Leigh and her husband, Pat, who relocated from Snoqualmie, WA, to Caldwell, ID, in 2019. Leigh has been a loyal State Farm customer since she was just 16 years old and brings over a decade of experience as a licensed producer in Property, Casualty, Life, and Health insurance. She truly enjoys working with both current and prospective State Farm customers, with a strong commitment to providing insurance education. Together, Leigh aims to ensure that everyone has the right insurance coverage to protect their valuable assets. One of Leigh's strengths lies in her ability to dig deep and assist our customers with policy reviews. She excels at explaining the meaning of each coverage and how it applies to their unique lives. Despite being semi-retired, Leigh's passion for insurance makes her a self-proclaimed "insurance nerd" who genuinely loves helping our customers. Her friendly and helpful approach has earned her high praise from our customers, and she is a wonderful addition to our team.

Viewing team member 4 of 6

Lloyd Lyman

Account Manager

License #18244490

I was born in eastern Idaho and spent my early years as a farm boy outside of Blackfoot, prior to moving to Oregon where I eventually met and married my wife and raised our family.

Over 10 years ago, we moved back to Idaho and settled in the Treasure Valley. For the last eight years, I’ve helped individuals, and their families create personalized plans to protect what matters most, grow their wealth, and prepare for a confident retirement so they can enjoy life today while securing their tomorrows.

As a husband, father of three, and a proud “Papa” to twelve amazing grandkids, I know firsthand how important it is to plan wisely and protect what we’ve worked hard to build. We cherish every chance we get to spend time with our growing family – and I bring that same level of care and commitment to helping you protect yours.

Viewing team member 5 of 6

Jenny Mejia Quebrado

Account Manager

License #21567506

I come from a large and close-knit family, which has greatly influenced my values and approach to life. Growing up in the beautiful Treasure Valley, I developed a deep appreciation for the stunning natural landscapes that Idaho offers. On weekends, I love to venture out and explore the great outdoors, whether it’s hiking in the foothills, fishing in local rivers, or simply enjoying a picnic in one of our scenic parks.

While I am primarily based in the Treasure Valley, I also had the opportunity to spend some time in southeastern Idaho while studying at BYU-Idaho. This experience not only enriched my education but also allowed me to connect with a diverse community and further appreciate the beauty of our state.

My passion lies in empowering customers through education. I firmly believe that informed customers make the great decisions for their unique circumstances. I take great pride in customizing insurance plans that cater specifically to the individual needs of each customer, ensuring they have the right coverage to protect what matters most to them. I look forward to building meaningful relationships and helping customers navigate their insurance options with confidence.

Viewing team member 6 of 6

Boone Bartlome

Account Manager

License #19299330

I was born and raised in Kuna Idaho. I grew up playing any sports I could as well as rodeoing with my family.

In 2013 I was paralyzed from the neck down after a freak accident during a high school football game. I have recovered far more than what doctors ever anticipated, and after relearning how to navigate life I’m happy to say I’m doing great and am so thankful for the support of my wonderful friends, family, and community during those tough times.

Since then, I have graduated from Boise State University in Finance and in 2024 built my own house in Kuna where I plan to be for the foreseeable future. I now spend my free time enjoying all the amazing outdoor activities Idaho has to offer!